When Futures Overreact (Part 2): Sharpening the Edge

Based on the paper Short-Term Basis Reversal

A few weeks ago, I shared a post about a surprisingly consistent edge found in the weekly spread between nearby futures contracts. The idea was simple, when spreads stretch, they tend to snap back.

This anomaly, documented in the

Short-Term Basis Reversal paper, gave us the foundation for a market-neutral strategy that went long the most negative spreads and short the most positive.

You can read the original write-up here if you missed it: When Futures Overreact: A Weekly Edge

Since then, we've added the strategy to the strategy library at QuantReturns.com and started refining it, by tweaking the contract selection logic. This post is a short update on those changes and what we learned along the way.

From Research to Production

When exploring ideas like this, we usually begin in Python. It's flexible, fast, and great for testing hypotheses.

But if something looks promising, something worth tracking live, I’ll migrate it into a more robust, production-grade backtesting setup. That lets us monitor it daily via the QuantReturns strategy portal.

This basis reversal strategy made the cut.

Once I industrialised it, I started playing with the rules for how we choose the F1 and F2 contracts. Specifically, I began tightening the criteria for how far away each contract is from expiry.

And it turns out — that small change made a big difference.

Cleaner Signals

The original strategy followed the paper closely: it selected the two nearest contracts that had at least 30 days to expiry (or first notice date). Clean, simple, effective.

We then decided to test what would happen if selected the F1 and F2 contracts by including contracts with more than 60 days until expiry?

I reran the tests, rebuilt the strategy with the stricter rule, and compared the results.

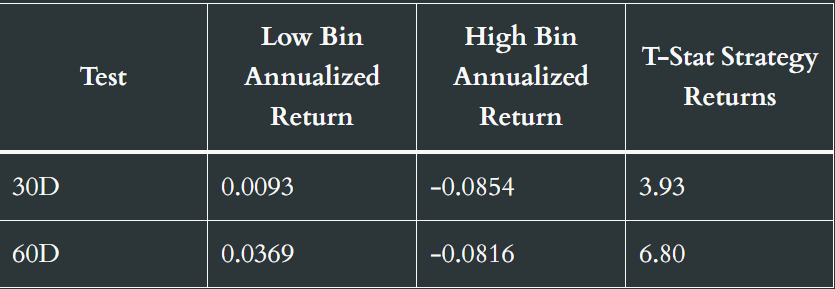

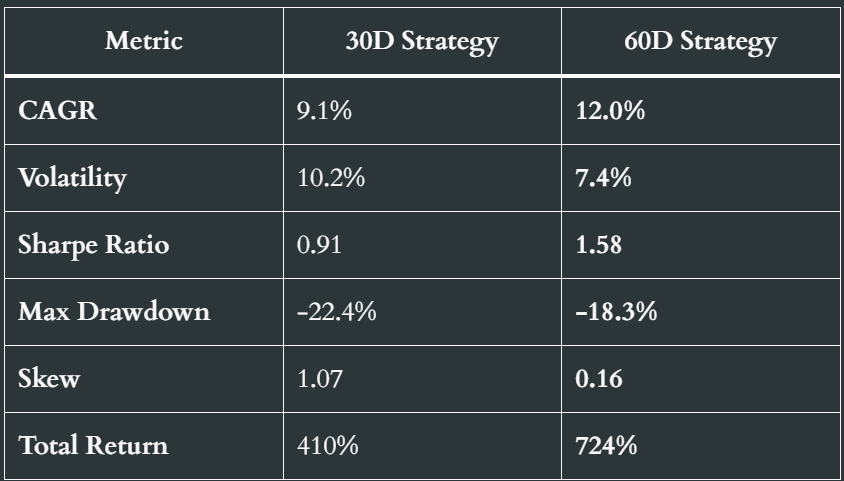

Results: 60-Day vs. 30-Day remaining.

Let’s break it down in two parts, the edge itself, and the strategy performance.

1. Edge Strength (Statistical and Economic)

When we look at the next-week spread return (t+1) across quintiles and bins, the 60-day filter gave us:

More significant differences in returns between the most stretched spreads and the most compressed.

A cleaner monotonic pattern: quintile 1 (most negative spreads) was strongly positive, quintile 5 (most positive spreads) strongly negative.

Higher t-stats and lower p-values, especially in the extreme quintiles.

But a Practical Caution — Liquidity

While the improved results could be due to noise reduction and a clearer signal, longer-dated contracts are often less liquid. In live trading, this can mean wider bid/ask spreads, less depth, and more slippage, making it harder to achieve the same fills you see in historical backtests. This is an important consideration when moving from research to execution.

Put simply: the signal is stronger, and less likely to be random.

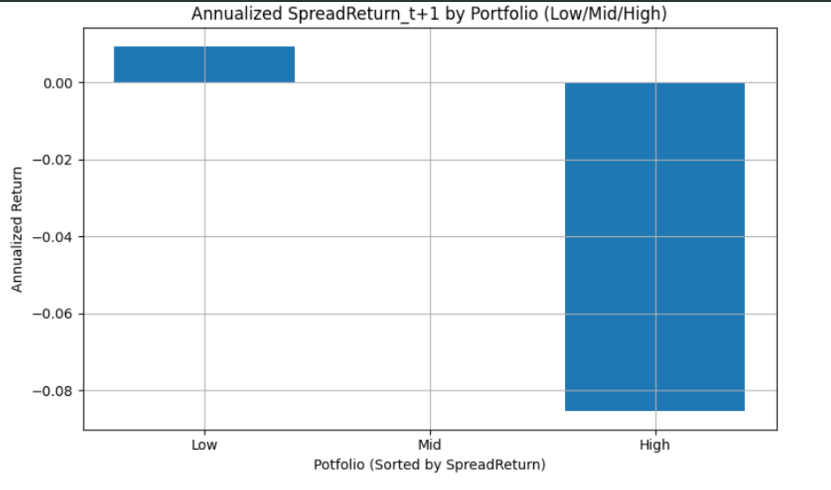

3 quintile buckets for the 30-Day strategy:

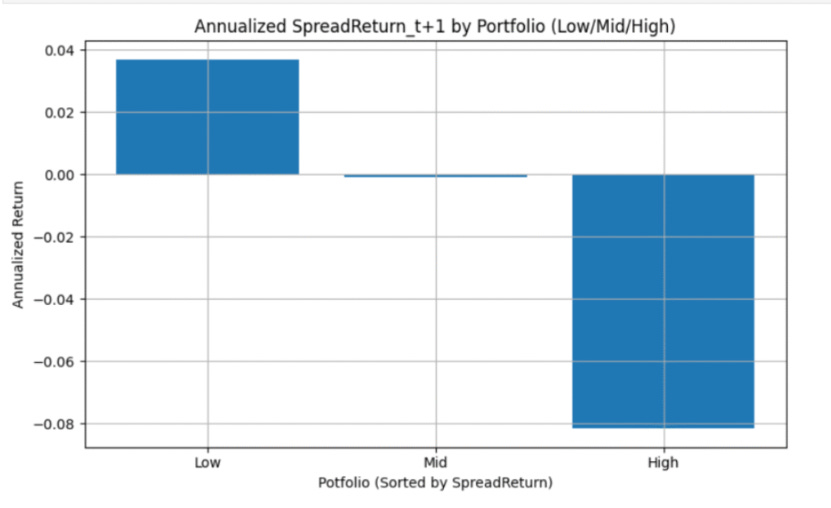

3 quintile buckets for the 60-Day strategy:

2. Strategy Performance

When implemented as a real strategy (long low-spread, short high-spread), the improvements carried through:

Not only is the signal stronger, but the execution is smoother. Lower volatility, higher Sharpe, shallower drawdowns — exactly what you’d hope for.

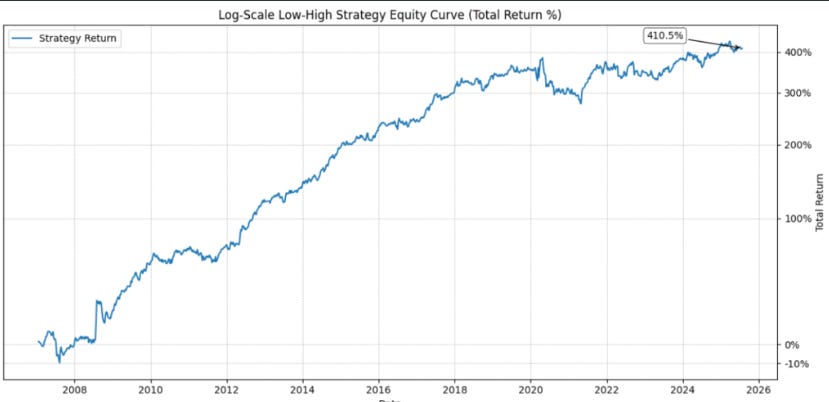

Equity curve for the 30-Day strategy:

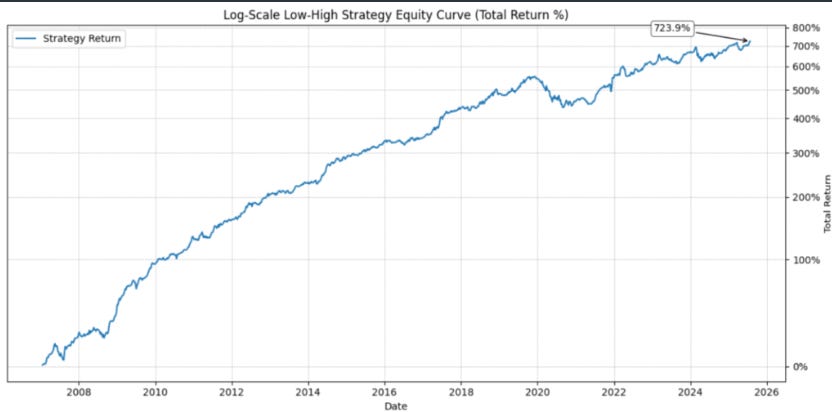

Equity curve for the 60-Day strategy:

It’s not just more profitable. It’s more robust.

Final Thoughts

This analysis shows a clear pattern - that pushing the contract selection further from expiry, significantly improves the Short-Term Basis Reversal strategy’s Sharpe ratio, reduces volatility and increases the statistical strength of the signal.

While the better results could be explained by reduction in noise (removing expiry-related distortions and isolating a cleaner mean-reversion signal), they could also be partly due to a more practical concern of liquidity. Longer dated contracts tend to be less liquid. In live trading, this could mean wider spreads, thinner order books, and less favourable fills than what you’d see in historical backtests.

That’s why this is still a fun but unfinished exercise. There’s more research to do here — ideally, we’d want to find the optimal two contracts that balance signal quality with execution feasibility. I’d also like to get to the point of testing this live to see how the real-world fills compare to the historical data.

Same edge. Sharper execution. But still some questions left to answer.

You can view this strategy in the QuantReturns.com strategy library, where its performance will be tracked over time. The 30-day, 60-day, and 90-day versions will be included so their results can be monitored and compared side-by-side as new data comes in. All performance tracking is for research purposes only and does not constitute investment advice.

Disclaimer

This website provides an assessment of the market and economic environment at a specific point in time. It is not intended as a forecast of future events or a guarantee of future results. The content is meant to present ideas for further research and analysis and should not be interpreted as a recommendation to invest.

This material does not provide individualized advice or recommendations for any specific reader. Forward-looking statements are subject to risks and uncertainties, and not all relevant risks related to the ideas presented may be covered. Actual results, performance, or achievements may differ materially from those expressed or implied.

The information is based on data gathered from sources we believe to be reliable. However, its accuracy is not guaranteed, it does not purport to be complete, and it should not be used as a primary basis for investment decisions.

Readers are encouraged to conduct their own due diligence and consider their individual investment objectives, risk tolerance, time horizon, tax situation, liquidity needs, and portfolio concentration. Consulting with a professional adviser is recommended to determine whether the ideas presented here are suitable for your unique circumstances.

By using the information in this article, you agree that the author and publisher are not liable for any direct or indirect losses resulting from your use of the material.